costa rica taxes vs us

There are an estimated 50000 Americans living in Costa Rica. Income taxes on individuals in Costa Rica are levied on local income irrespective of nationality and resident status.

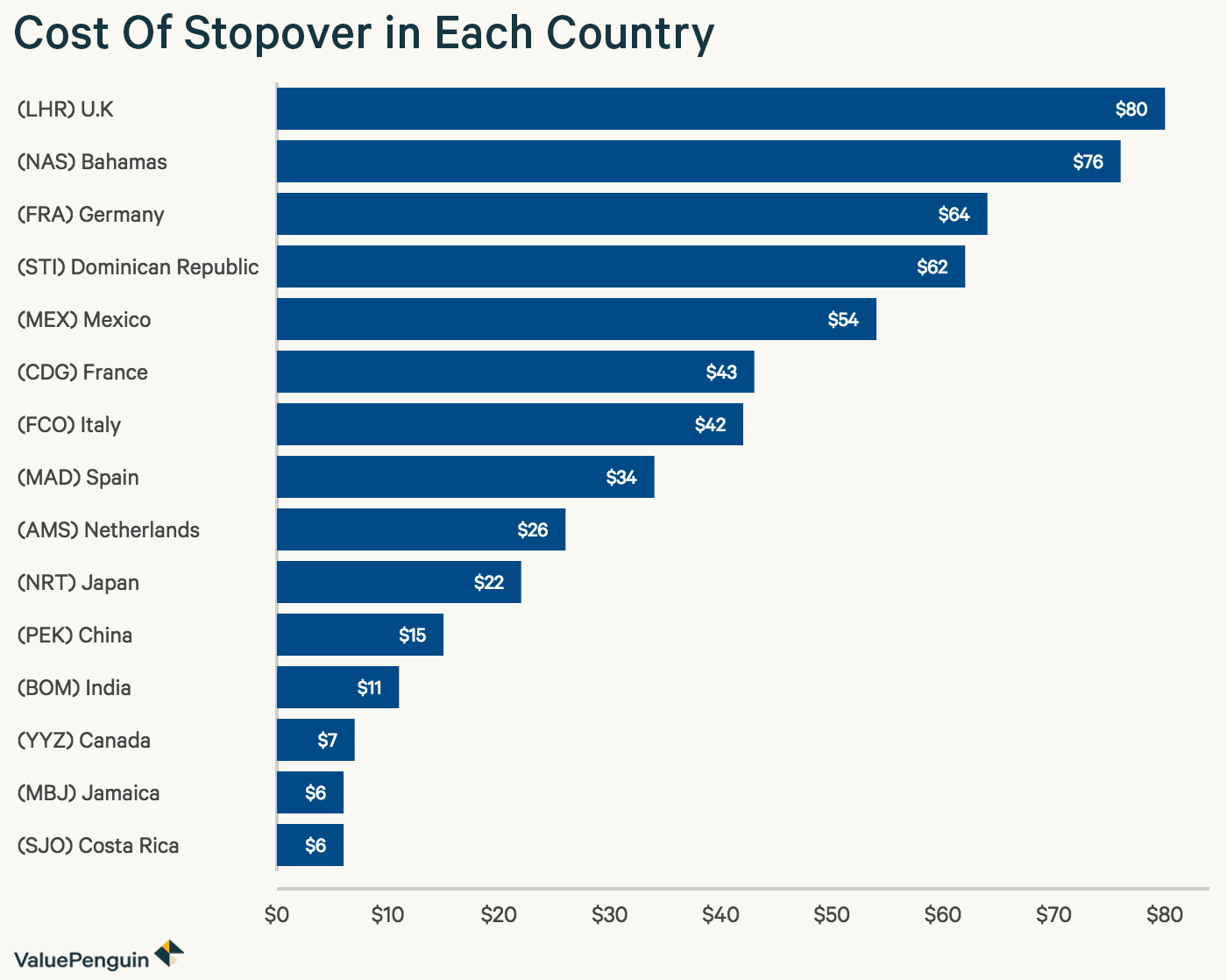

The Taxes That Raise Your International Airfare Valuepenguin

Owners of Costa Rica real.

. Income tax rates for both companies and individuals are calculated on a progressive scale depending on gross income. In 2021 the tax rate for. The penalty for failing to file Form 5471 can be 10000 or more.

2022s tax was 69330 approximately US109 per inactive corporation. In Costa Rica you might actually have to pay luxury task on your property. 74 of GDP vs 5 of GDP.

The tax is levied on both employment source income and non-employment source income. Has public health care. The tax increases slightly each year and is due annually at the end of January.

GDP PPP constant 2005 international. Income subject to tax in this country includes employment income self-employment business income. Costa Rica has a progressive tax rate for individuals that ranges from 0 to 25.

In case of legal entities income tax ranges. 48 more education expenditures. Non-residents including Americans who spend less than 183 days a year in Costa Rica are also subject to a.

This involves a property transfer tax of 15 of the. Randall Linder of US. Costa Rica has a progressive tax rate for individuals that ranges from 0 to 25.

The maximum tax rate of 15 percent for employment income and 25 for. Taxpayers are required to file for taxes if their income exceeds a certain amount. Now this tax applies to houses condos and apartments whose value of construction was beyond.

For US income tax purposes these are corporations and must be reported on Form 5471. Single and 65 or older. Compared to the region this puts the country on the lower end of individual tax rates.

Every individual employed in Costa Rica must pay a monthly withholding tax that is based on hisher. CRC 0 - 41112000. Income GDP PPP Constant 2005 international per capita.

Residents pay Costa Rican income tax at relatively low rates on a scale of 1 to 25. CRC 41112000 - 82698000. Last reviewed - 03 February 2022.

Non-residents including Americans who spend less than 183 days a year in Costa Rica. Costa Rica calculates tax differently for different types of income. PPP GDP is gross domestic product converted to international dollars using.

How does Costa Rica compare to United States. When property is purchased in Costa Rica it must be transferred into the buyers name. In Costa Rica income tax rates are progressive.

Compared to the region this puts the country on the lower end of individual tax rates. The annual property tax in Costa Rica is assessed at a fixed rate of 025 of the propertys value per year. Under the Costa Rica tax system residents and corporations are taxed only on income.

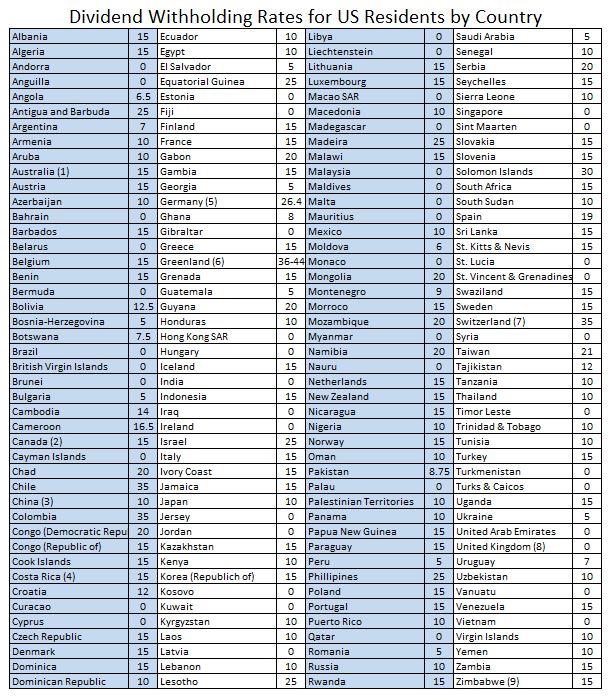

Things To Consider Before Investing In Foreign Dividend Stocks Seeking Alpha

Cost Of Living In Costa Rica Full Breakdown International Citizens

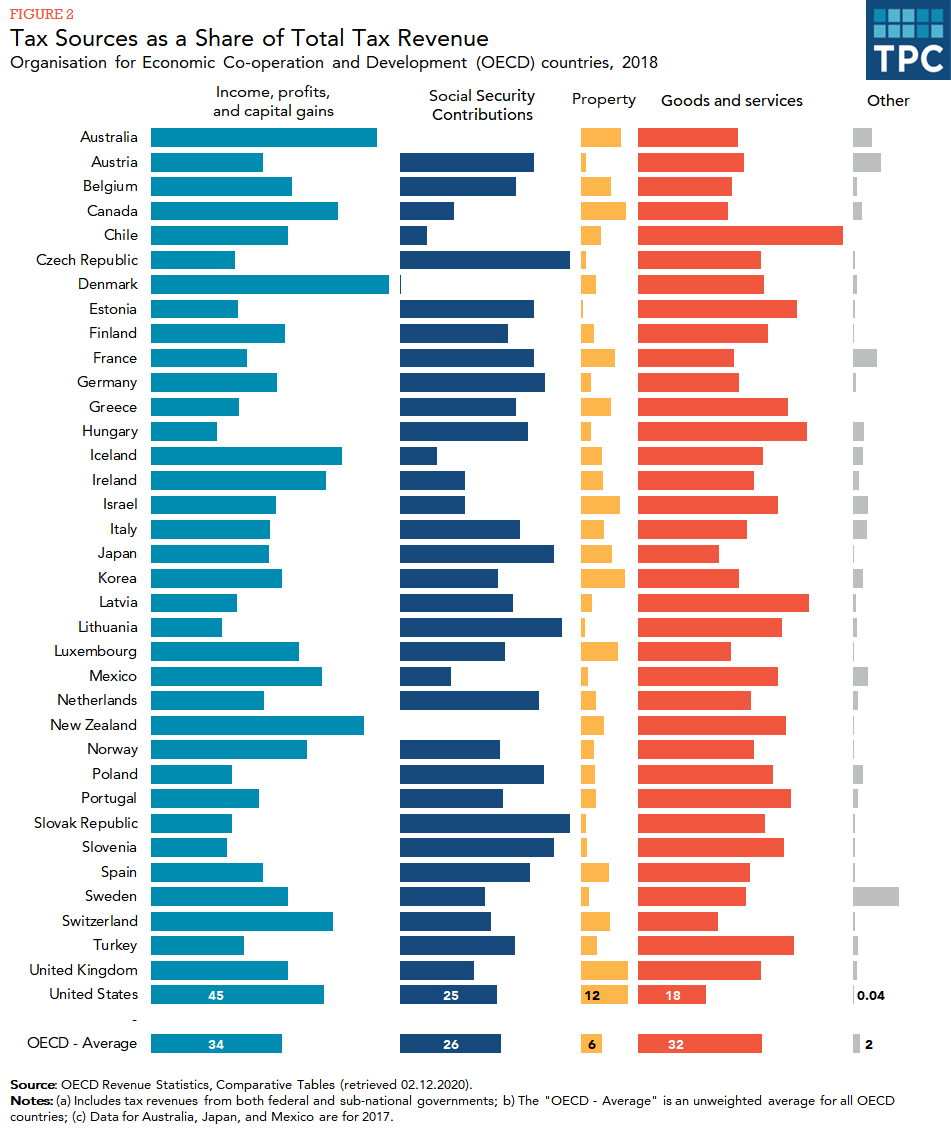

How Do Us Taxes Compare Internationally Tax Policy Center

Paying Costa Rica Income Taxes As A Us Citizen

6 Tax Tips That Every American Expat In Costa Rica Should Know

/CIA_map_of_the_Caribbean-822e94431d4647ba9ca350ebf28eb23b.png)

Top 10 Offshore Tax Havens In The Caribbean

Effective Tax Rates On U S Multinationals Foreign Income Under Proposed Changes By House Ways And Means And The Oecd Penn Wharton Budget Model

Travel Insurance For A Costa Rica Vacation Forbes Advisor

Corporate Tax Rates Around The World Tax Foundation

How To File Us Income Taxes When Living In Costa Rica Online Taxman

Panama Vs Costa Rica Which Meets Your Must Have Criteria

3 Great Countries To Live In Central America Other Than Costa Rica

![]()

Tax Guide For Us Expats Living In Costa Rica

Is Costa Rica Us Territory Or A Sovereign Nation

Us Taxes 1040 Nr For Non Residents

Simple Tax Guide For Americans In Costa Rica

Property Taxes In Costa Rica Plus Luxury Home Tax And Corporation Tax Osa Tropical Properties

Costa Rica Indirect Tax Guide Kpmg Global

Tax Revenues In Latin America And The Caribbean Take A Historic Hit Before Showing Early Signs Of Recovery Economic Commission For Latin America And The Caribbean