wyoming tax rate for corporations

So your initial costs. This fee is levied against the in-state assets of limited partnerships LLCs and corporations doing business in the state.

Tax Foundation Reveals Nj Has Highest Corporate Income Tax Rate New Jersey Business Magazine

39-15-105 a viii O which exempts sales of tangible personal property or services.

. Counties in Wyoming collect an average of 058 of a propertys assesed fair. The state sales tax in Wyoming is 4 tied for the second-lowest rate of any state with a sales tax. Cheyenne WY 82002-0110.

Performed for the repair assembly alteration or improvement of railroad rolling. The tax is either 60 minimum or 0002 per dollar of. 327 to have us form the Wyoming LLC for you.

Wyoming has a 400 percent state sales tax a max local sales tax rate of 200. That means the company does not pay taxes at the company level only the owners shareholders or members. Wyoming Department of Revenue.

On top of that rate counties in Wyoming collect local sales taxes of up to 2. Wyoming does not have an individual income tax. Get a quote from.

Corporate rates which most often are flat regardless of the amount of income. The tax credits would also reduce the effective corporate tax rate of those paying any of the taxes listed above. Form your Wyoming LLC with simplicity privacy low fees asset protection.

The annual report fee is based on assets located in Wyoming. Up to 25 cash back Tax rates for both corporate income and personal income vary widely among states. Registering for Wyoming Business Taxes Online.

1000 or so to talk to your CPA. Wyomings proposed corporate income tax only falls on a few select industry sectors at least initially but its a foot in the door for a broader corporate taxsomething. Wyoming Internet Filing System WYIFS The.

This fee is 60 or two-tenths of one million on the dollar 0002 of all in-state. A Wyoming LLC also has to file an annual report with the secretary of state. Wyoming also does not have a corporate income tax.

Because your Wyoming corporation income flows through to your personal tax return you must pay self-employment tax also known as FICA Social Security or Medicare tax on your. Wyoming Department of Revenue Website. If there have not been any rate changes then the most recently dated rate chart reflects the rates currently in effect.

Wyoming Department of Revenue. If you use Northwest Registered Agent as your. This bill in both past and current versions has been sold as a way to bring money.

Wyoming does not have an individual income tax. Ad Our 199 LLC formation service includes Bank Account provides everything you need. The median property tax in Wyoming is 105800 per year for a home worth the median value of 18400000.

Wyomings license fee amounts to 0002 for every dollar of in-state. Tax rate charts are only updated as changes in rates occur. Wyoming corporations and Wyoming LLCs are required to pay a fee each year when filing their annual report.

Wyoming also does not have a corporate income tax. Wyomings license fee amounts to 0002 for every dollar of in-state. 1000 or so to talk to your local lawyer.

Herschler Building 2nd Floor West. An S-Corp is a pass-through entity and so the earnings are not taxed twice.

Wy Llc Taxes How Are Wyoming Llcs Taxed

How Idaho S Taxes Compare To Other States In The Region Boise State Public Radio

How Much Are Taxes For A Small Business Bench Accounting

Wyoming Llc Benefits Advantages Of Llcs In Wy

State Corporate Income Tax Rates And Brackets For 2020

A New Minnesota Law Is Saving Certain Kinds Of Businesses A Boatload In Federal Income Taxes Minnpost

Corporate Tax Rates By State Where To Start A Business

Corporate Tax In The United States Wikipedia

Historical Wyoming Tax Policy Information Ballotpedia

Laying The Foundation Funeral Home Consulting

Wyoming State Economic Profile Rich States Poor States

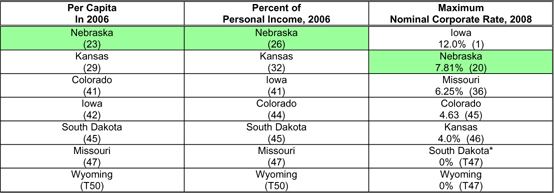

Taxes And Spending In Nebraska

How To Start A Business In Wyoming A How To Start An Llc Small Business Guide

Comparison Of Corporate Income Tax And A Download Table

A Corporate Income Tax In Wyoming Legislation That Would Enact It Is Moving Forward 307 Politics Trib Com

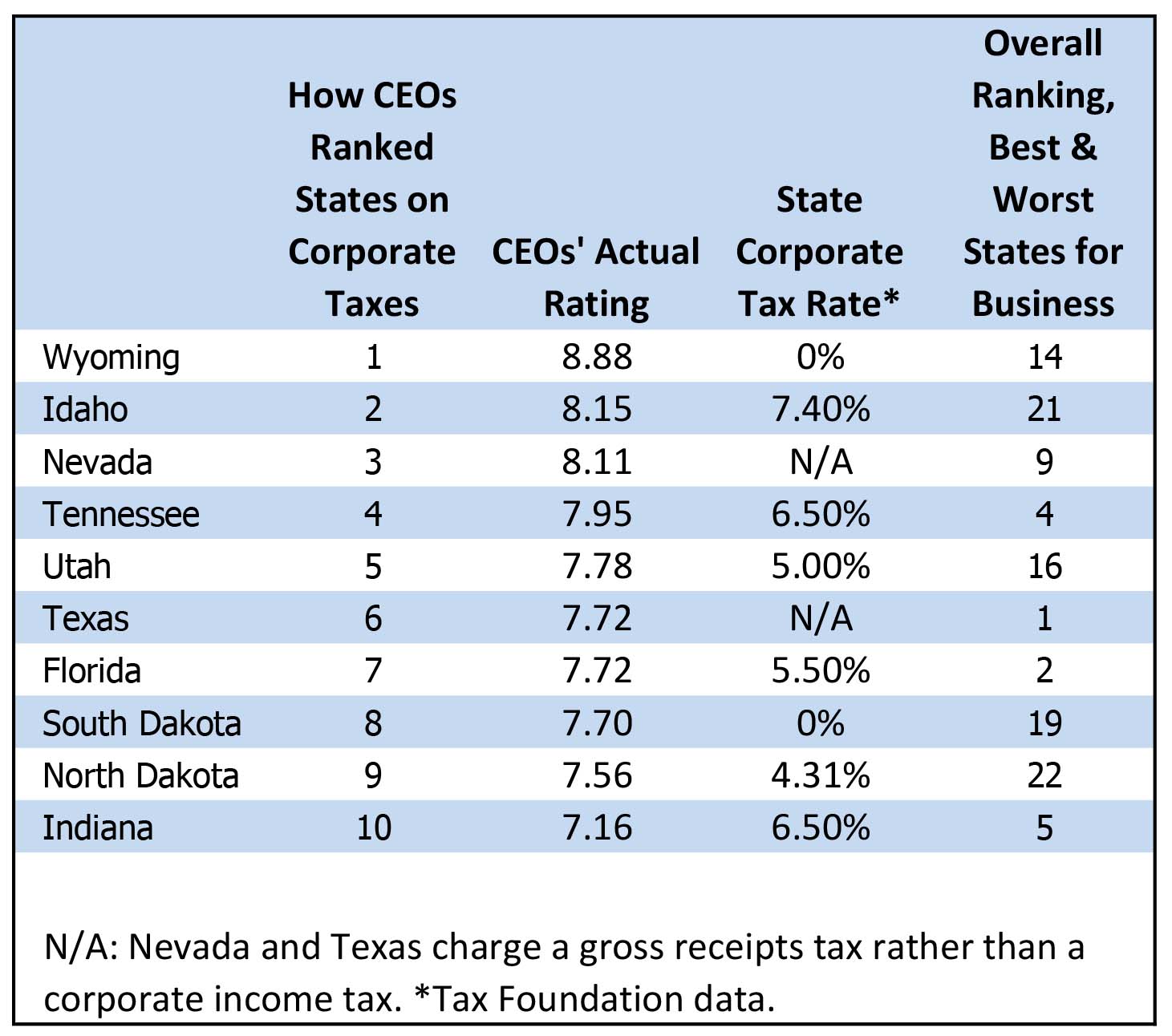

The Top 10 States With The Lowest Corporate Tax Rate

The Most Tax Friendly U S State For Retirees Isn T What You D Guess And Neither Is The Least Tax Friendly Marketwatch

/TermDefinitions_Incometax_finalv1-2c3f527bde3a41c296b6389fda05101d.png)